On January 19, the 2025 Spring Festival movie pre-sale started. As of 14:27, the total pre-sale box office exceeded 100 million yuan, breaking the record for the fastest pre-sale of 100 million yuan in Chinese film history. At the same time, this year's Spring Festival movie also set records for the fastest pre-sale to break 10 million yuan and the longest average movie duration.

According to Maoyan Professional Edition data, as of 20:43 on the 19th, the pre-sale box office of new films during the Spring Festival exceeded 150 million yuan, among which "The Legend of the Condor Heroes: The Greatest Hero", "Nezha: The Devil Child Conquers the Dragon King" and "Detective Chinatown 1900" ranked in the top three in the pre-sale box office.

In 2024, my country's film market entered a period of adjustment, with annual box office revenue of 42.502 billion yuan, down 22.7% year-on-year, and the number of moviegoers was about 1.01 billion, down 23.1% year-on-year. According to Maoyan Professional Edition data, although the total number of movie screenings in China in 2024 reached 143 million, an increase of about 10% over 2023, the average ticket price fell to 42 yuan, a decrease of 0.2 yuan from 2023.

The "2024 China Film Market Annual Inventory Report" (hereinafter referred to as the "Report") released by the Lighthouse Research Institute shows that the total number of domestic films released in 2024 is 430, which is basically the same as in 2023, but 68% of the films in 2023 were approved in the early years. The number of films approved for filing in 2024 exceeds 2,700, which is higher than in 2023. This means that the supply side of the film industry is resuming its production rhythm.

The above report shows that in 2024, 57% of the audience will only watch a movie once a year, and 84% of the "new audience" will come because of the movies released during the popular schedule. Historical data shows that from 2016 to 2019, the proportion of audiences who only watch a movie once a year dropped from 48% to 44%. But by 2023, this proportion increased to 51%, and further increased to 57% in 2024. At the same time, the total number of audiences dropped from 500 million in 2023 to 430 million, and the average frequency of movie watching per person dropped from 2.6 times to 2.3 times.

Yuan Shuai, executive vice president of the Agricultural, Cultural and Tourism Industry Revitalization Research Institute of the China Academy of Urban Development, said in an interview: "The film market in 2024 was lackluster. In terms of film types, although it covers a variety of genres such as comedy, suspense, science fiction, and action, it lacks innovation and breakthroughs overall and has failed to form a strong market appeal. The overall box office performance was poor, which declined compared with previous years, especially the lack of blockbuster movies with a wide influence, resulting in insufficient market heat."

However, the 2025 Spring Festival period has broken many records, including the fastest pre-sale box office of over 100 million yuan, which means that the film market has shown signs of recovery. Some industry insiders believe that with the recovery of production capacity and the release of blockbusters, the 2025 Spring Festival period is expected to set a new record in box office and number of moviegoers.

Recently, A-share cinema companies such as Wanda Film, Hengdian Film and Television, and Blue Ocean Entertainment have disclosed their 2024 performance forecasts.

Wanda Film's performance forecast shows that the company expects to lose 850 million to 950 million yuan in 2024 and make a profit of 912 million yuan in 2023. Wanda Film said that in 2024, affected by factors such as insufficient supply of top films, the film market performed relatively sluggishly, with national box office revenue of 42.502 billion yuan, down 22.7% from 2023, and moviegoers of 1.01 billion, down 23.1% from 2023. The output of single screens declined year-on-year, and cinema operations were under pressure.

In 2024, Wanda Cinemas' domestic directly-operated theaters achieved a box office of 5.72 billion yuan (excluding service fees), a year-on-year decrease of 24.3%, and 140 million moviegoers, a year-on-year decrease of 23.7%. At the same time, the traditional non-box office revenue of theaters was also affected by the decline in the number of visitors. Wanda Cinemas said that although the company's single-screen output is close to 1.9 times the national average, due to the high fixed costs of theater depreciation, rental, energy consumption, etc., the company's domestic theaters still suffered a certain degree of loss.

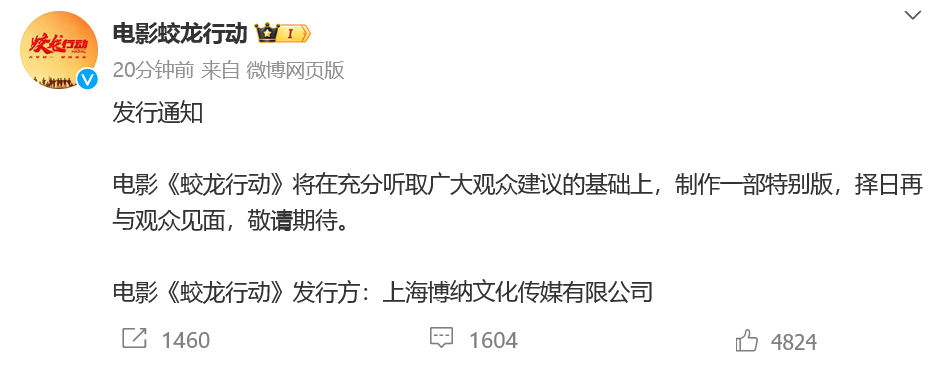

At the same time, Wanda Film said that the supply side of films continued to pick up in 2025, and many heavyweight films were scheduled for the Spring Festival at the beginning of the year. In addition to "Detective Chinatown 1900" and "Boonie Bears: Reboot" invested and produced by the company, "Nezha: The Devil Boy Conquers the Dragon King", "Fengshen II: War in Xiqi", "The Legend of the Condor Heroes: The Greatest Hero" and "Operation Jiaolong" are also scheduled to be released during the Spring Festival, which is expected to boost demand for movie-watching and drive the box office to achieve new success at the beginning of the year.

On the evening of January 17, Hengdian Film and Television released a performance forecast showing that the company is expected to have a net loss of 90 million to 120 million yuan in 2024. Hengdian Film and Television said that due to the slowdown in national economic growth, insufficient supply of top films, a decline in the overall box office, and lower-than-expected demand for movies, the company's film screening business revenue and related derivative business revenue decreased year-on-year. The company continues to strengthen business management and refined management, continue to reduce costs and increase efficiency, and strengthen internal control, but it still bears relatively rigid and relatively large-scale costs such as rent, energy consumption, asset depreciation, amortization, and labor.