Recently, Gould Street Data Analysis Company in the UK, which likes to predict the global annual movie box office, revised its 2025 movie box office forecast data, raising it from the original $33 billion to $34.1 billion.

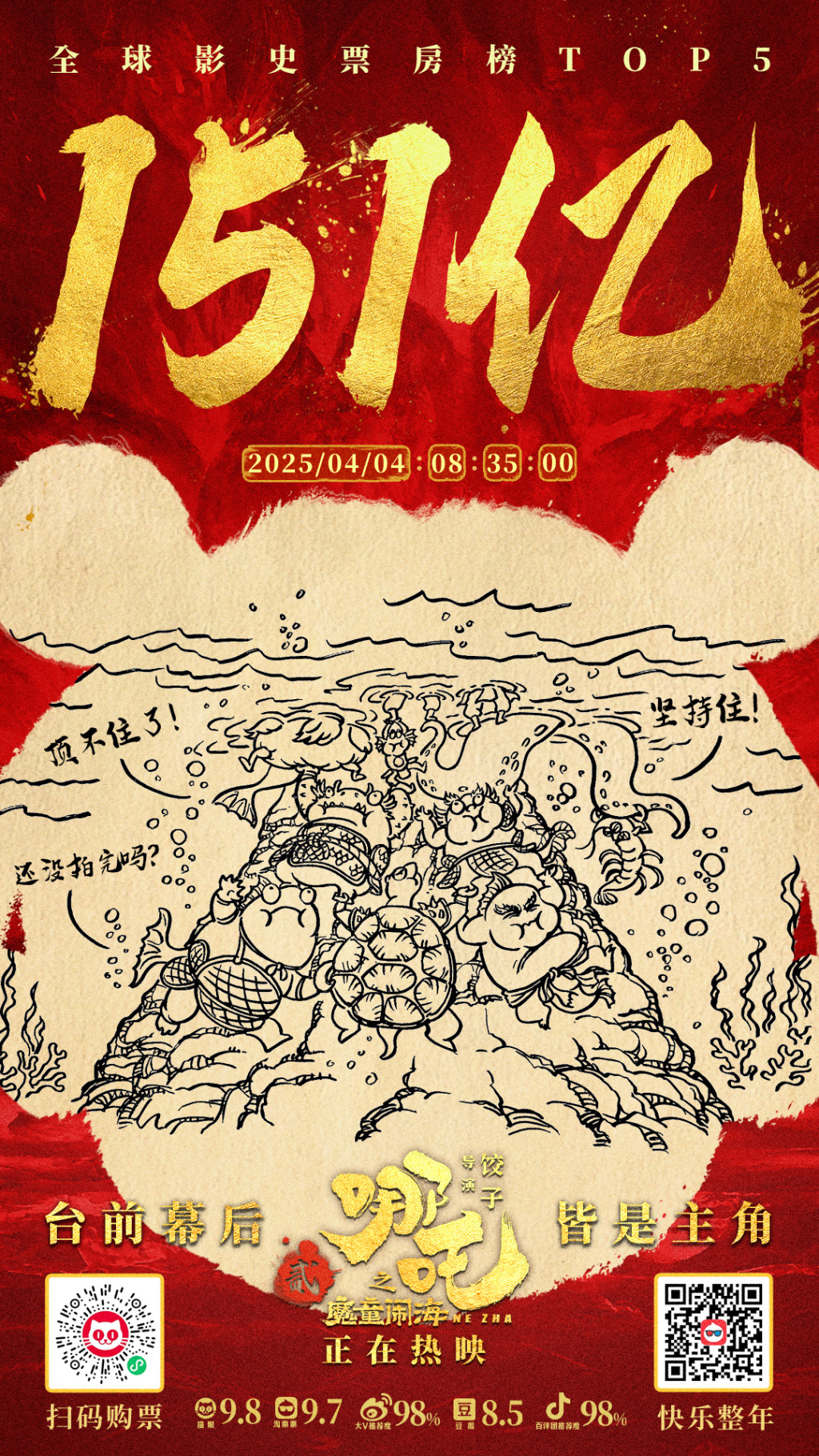

At first glance, it seems that Gould Street has considerable confidence in the future market, but in fact, the $1.1 billion increase is almost entirely attributed to the annual box office in China alone, and the reason behind this is obviously the unexpectedly strong performance of "Nezha: The Devil Boy Conquers the Dragon King". At present, the film has achieved a box office of more than 15.1 billion yuan in mainland China, and there is no sign of it coming off the shelves.

Nezha 2's box office in China alone has exceeded 15.1 billion yuan

On the other hand, in the world's largest North American market, Gould Street's forecast has fallen instead of rising, from $9.7 billion to $9.5 billion. This is indeed very consistent with the extremely weak situation of the North American film market since the beginning of the year.

At the end of March, according to statistics, the North American box office revenue in the first quarter of 2025 was only 1.44 billion US dollars; compared with the same period in 2024, there was a gap of 11 percentage points; compared with 2019, it was more than 30 percentage points behind; if compared with the first quarter of 2018 with a total revenue of 2.8 billion US dollars, it would be a drop of nearly 50%.

At the end of March and the beginning of April, the annual film industry conference CinemaCon arrived as scheduled. This is the platform for Hollywood companies to showcase their future new works to theater representatives and audiences. In order to avoid the same name as NATO, the North American Theater Industry Organization (NATO) recently changed its name to "Cinema United". Its CEO Michael O'Leary continued to cheer up his peers at the film industry conference and told the media that he believed that the North American box office performance in 2025 would continue to grow, and in 2025 or 2026, the North American box office data would eventually return to the level before the epidemic.

Cinema United said at CinemaCon that North American box office will continue to rise in 2025 © Cinema United

"The first quarter of this year was indeed difficult, but we have high hopes for the second, third, and fourth quarters. Some would say that this year will be the year of a full revival of the North American film market, some think that this year's achievements will go down in history, and others believe that this year is still a transitional year before returning to normal, but it will also be the last transitional year. I haven't heard anyone say that this year's box office will be lower than in 2024." Eduardo Acuna, CEO of Regal, the second largest cinema chain in North America, also spoke with confidence.

Obviously, he was unaware of the existence of a securities analyst named Doug Creutz. Unlike these theater operators, Doug Creutz, an outsider, is a senior analyst at the financial institution TD Securities. He believes that it is undoubtedly a foolish dream to still expect everything to return to the past in 2025, six years after 2019, the last normal year before the epidemic.

At the end of March, he completed a cinema industry assessment report titled "Memo to Hollywood", which clearly stated that the North American film market might be about to enter a "vicious cycle". The combination of the reduction in the number of new films and the reduction in the size of cinemas has led to a continuous decline in box office revenue. "The so-called box office recovery is doubtful. We don't think that this can be achieved by just a few blockbusters." He wrote in the 20-page report, "The number of screens in the United States has dropped from 41,000 before the epidemic to about 35,000 now. In the short term, fewer theaters may benefit the surviving theater owners, but in the long run, it may eventually accelerate the decline of the overall business. Because the total number of theaters is small, it means less total box office revenue, which may cause more movies to skip theaters and go directly to streaming media, and this is what we call a vicious cycle."

Cruz stressed that this does not mean that the theatrical window period (i.e. the theatrical protection period before the film enters the streaming media) will completely disappear, but as major film companies focus their energy on a few films with more mature IPs, the number of films that can enter the theater will definitely decrease overall, and there will be fewer and fewer films that retain the complete window period. As a sample to support his point of view, eight of the top ten films in the North American box office list last year were sequels or so-called derivative works or reboots.

Captain America 4 tops North American box office charts in 2025 with nearly $200 million

Moreover, the combined box office of the top 20 movies in the North American annual box office last year accounted for 64% of the total North American box office; between 2015 and 2019, the average of this data was only 52%. In other words, high attendance rates are concentrated on a smaller and smaller number of films. In a poll conducted at the end of 2024, only 25% of American audiences said they were willing to go to the cinema at least once every other month; in 2019, 40% of the audiences surveyed were willing to go to the cinema at least once every other month.

Unfortunately, Doug Cruz's report did not predict specific data for this year's North American box office. Last year, the annual North American box office reached $8.72 billion, and even the revised forecast of Gould Street Analysis believes that this year's North American box office will increase compared to last year. In the end, whether the optimists are right or the pessimists like Cruz are unfortunate, the results will be known in nine months.